The pandemic was not enough to spur the Italian wine companies and convince them to open an e-shopping channel. Despite the - exceptional - numbers of online sales during the lockdown, the wine sector is still behind. As shown by the survey “Il gusto digitale del vino italiano” (The digital taste of Italian wine) signed by Omnicom Pr Group Italia, which analyzed the presence and online activities of the top 25 Italian wine companies as surveyed by Mediobanca’s 2020 report, only 6 out of 25, less than a quarter, have their own online shop, the same as last year. Some of the wineries (8 out of 19 not equipped with proprietary e-commerce) prefer to indicate on their websites wine shops, some of which have online wine shops, where you can buy and taste the products. Even if the brands remain willing to accompany the consumer throughout the purchase process, and when this is not possible, “qualified” third parties are suggested. On the positive side, there was the race for solidarity during the health emergency of Covid-19, with the charitable initiatives of 14 companies out of 25.

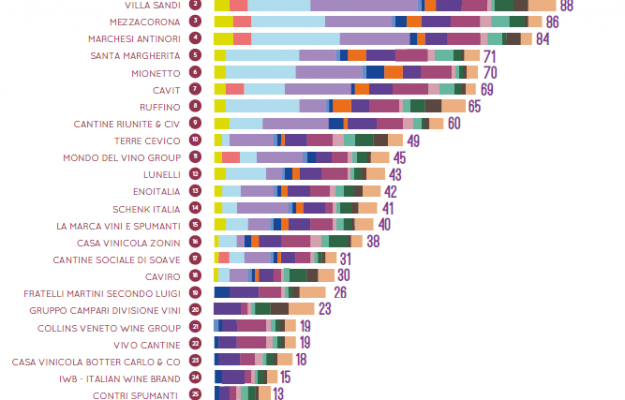

The research, which ranks the companies according to the level of digitalization, puts Frescobaldi in the first place (90 points), followed in the top ten by Villa Sandi (88), Mezzacorona (86), Antinori (84), Santa Margherita (71), Mionetto (70), Cavit (69), Ruffino (65), Cantine Riunite & Civ (60) and Terre Cevico (49). Looking at the social presence of the wine companies. Instagram is the favorite, with an increase in the number of followers of 51% on 2019. To date, 16 out of 25 companies have an official Instagram account, with content related to food pairing and the face of influencers, essential also in wine, which concern the Instagram communication of 50% of wineries. Facebook is saturated, numerically speaking, with just +1.2% growth in the number of followers of the analyzed brands’ accounts, while the weekly update frequency remains unchanged compared to 2019. YouTube is manned (with few updated content) by 11 companies, Twitter only by 9, and Wikipedia, which is not social but has its own role in Serp (Search engine results page), is manned by only 3 wineries.

14 out of 25 companies have communicated initiatives promoted in response to the Covid-19 emergency. They were: online tastings with sommeliers and mixologists, streaming aperitifs with influencers, stories related to quarantine. The initiatives were mostly recounted on social media, the real protagonists of communication to the public, compared to sites, much more “static”. The content related to Corporate Social Responsibility is also growing with 10 out of 25 companies (they were 7 out of 25 in 2019). The main focus is on initiatives related to art and culture. As in 2019, 100% of companies (76% in 2018 and 37% in 2017) deal with sustainability by mentioning certifications, energy efficiency, sustainable management of natural resources and pesticide free agriculture. Some companies have a dedicated section on the site, with more information, infographics, data and insights.

All companies mention, in various ways, the native grape varieties (as in 2019 while in 2018 they were 64%). The level of detail varies: some wineries don't just mention them, but dedicate space to the description of the grape varieties and the choice of use, while others devote particular attention to the theme with an entire section of their site (and an account of the program of use and recovery of native grape varieties). 13 wineries out of 25 (52%) refer to tasting paths (as in 2019, only 15% in 2014). The most virtuous also exploit the tourist vocation of the area, often with mention of places to visit and activities - including sports - to practice. Interesting is the trend of “food pairing” that sees 11 out of 25 companies (10 out of 25 in 2019).

In addition to Italian, English, German and Chinese are the most common languages on the websites of the companies analyzed. In 2020, English (25 out of 25 wineries, they were 21 in 2019) followed by German (9 out of 25, they were 7 in 2019) and Chinese (4 out of 25, they were 2 in 2019). Therefore, the most important markets for our export are well attended. On social channels, 14 out of 25 companies offer foreign language content (10 in 2019). As far as chats are concerned - almost all of them on Messenger - 15 out of 25 companies responded to requests for information compared to 12 out of 25 in 2019. Finally, the pandemic has also slowed down the multimedia production of content. Formats such as podcasts have not yet been explored by the companies analyzed despite the potential linked to the narration of the territory and products. Areas of improvement also come from the user experience of some sites, conceived to date to be only a showcase of products (only 8 out of 25 have a score higher than 7 on a scale from 1 to 10).

Copyright © 2000/2026

Contatti: info@winenews.it

Seguici anche su Twitter: @WineNewsIt

Seguici anche su Facebook: @winenewsit

Questo articolo è tratto dall'archivio di WineNews - Tutti i diritti riservati - Copyright © 2000/2026