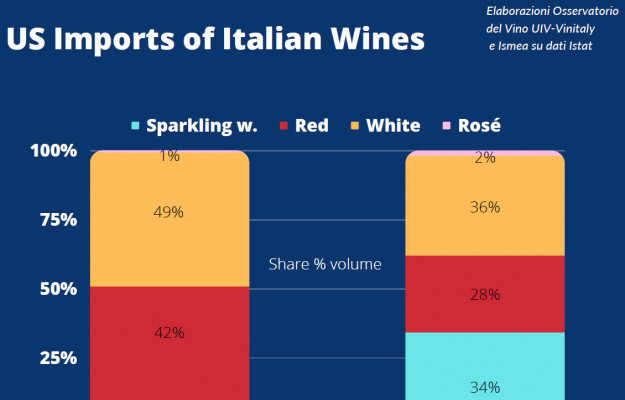

Lamberto Frescobaldi, president of the Unione Italiana Vini - UIV (Italian wines union) and head of one of the leading Italian wine groups, the FRESCOBALDI GROUP gave his snapshot of US wine market, on stage at “Vinitaly 2023”, stating, “The US is the leading market for Italian wine (exports totaled 1.8 billion euros in 2022, ed.), but it is a much more complicated market than it seems. In fact, we are talking about 50 states that have different rules, and different, quite complex access systems to deal with”. Several of the main players of Italian wine were also at the meeting on stage, such as Filippo Polegato (Astoria Wines), Gaetano Marzotto (Santa Margherita), Massimo Romani (Argea) and Massimo Tuzzi (Terra Moretti), among others, “interviewing” Robert Tobiassen, president of the US Wine & Beverage Importers of the Nabi-National Association of Beverage Importers. Tobiassen analyzed the market that for Italian wine has changed profoundly in the space of just a few years. In 2010, exports of Italian wines to the United States, in volume, according to data from the Wine Observatory of Unione Italiana Vini-UIV, Vinitaly and ISMEA from ISTAT data, was 49% white wines, 42% reds and only 9% bubbles. In 2022, the mix, instead, put whites still in the lead, but only 36% of the total, sparkling wines reached 34%, and reds were 28%, while rosés went from 1% to 2%. And sales were quite polarized: 8% split between Chianti and Lambrusco, and 42.2% the others. Then, there are the new generations, especially “Gen Z”, who consume wine, but represent only 4% of the “regular wine drinkers”, which are still the “Boomers” at 47%.

And this, Tobiassen explained, is also “because young people are paying more and more attention to health". One of the trends that can be seen on the market is the rapid growth of DTC, direct-to-consumer, which benefits consumers and companies, since the added value is not dispersed in the various stages of distribution. However, it is an almost exclusive prerogative to American wines, which in any case, represent over 70% of the market. “And it is a situation that is unlikely to change. It could change maybe from a regulation point of view, for instance, if the Federal Government or individual States allowed it. But then the importers would in some ways be “overridden”, and probably wouldn't be too happy”. Furthermore, even today, “considering the success of Italian wine, I don't think the current concentration of importers and distributors is a big problem”, Tobiassen said. However, an unhappy importer — since the famous “3 Tier System” is the first filter to access the market for importers, distributors and retailers — would not be a good omen. It is a market where “varietal” prevails in the choice of wines, despite the strength of the Italian denominations.

Tobiassen continued in a pragmatic tone, saying, “Italian wine in the USA must not hang on to details of the product or denominations, but rather speak to consumers in a more direct, empathetic way, and it must know how to anticipate the experience. It is fundamental not only to use immediate language, but also to find the right channels to dialogue with the general public. I would consider the Super Bowl or basketball games for new formats. Most of all, the Italian producers must know how to identify the added value of their product in terms of pleasure and taste, when they present themselves to the American public; that is, what is the enhancement, the enrichment that a glass of their wine gives to the experience”. It is a more sensual than cultural approach, therefore, which goes beyond consumer profiling and the development of awareness that Italy offers.

Copyright © 2000/2026

Contatti: info@winenews.it

Seguici anche su Twitter: @WineNewsIt

Seguici anche su Facebook: @winenewsit

Questo articolo è tratto dall'archivio di WineNews - Tutti i diritti riservati - Copyright © 2000/2026