Considering the records of the last wine auctions in 2018, but also the trend of the platforms ratings such as Liv-Ex or Wine-Lister, it is not a big surprise, but rather a confirmation, that the wine has been considered one of the best sectors of financial investment, according to the “The Wealth Report 2018” of the agency specialized in luxury and real estate investments Knight Frank.

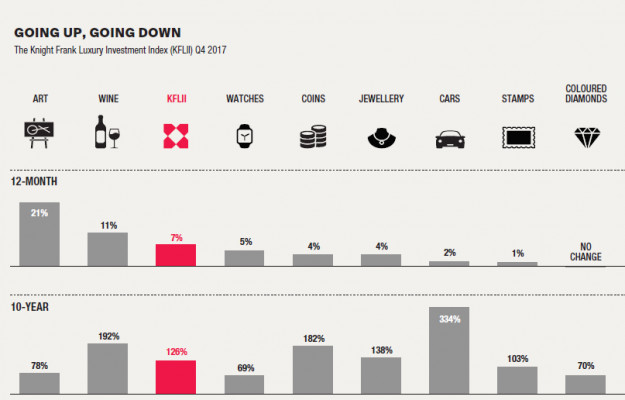

According to the Knight Frank Luxury Investment Index (edited with the Wine Owners platform), wine was one of the most productive sectors in 2017, with growth of 11% over a 12-month period, compared to 7% of the index average, with a performance second only to the art sector, which recorded growth of 21%, but more than twice as many watches, coins, jewelry, cars and stamps.

Even in the long term, the investment in wine is still the winner, considering that over 10 years the index of Knight Frank linked to wine, has grown by 192%, compared to +126% of the average, and second only to cars (+334%). If this was the trend of the recent past, it would not be a surprise if, in the next analysis, the wine wins, as happened in the past, the first place among the most profitable investments, after a 2018 that saw beat records on records, with the two most striking cases related to Romanée-Conti, with two bottles of 1945 beaten for 496,000 and 558,000 dollars at Sotheby’s, in New York, and a collection of over 1.360 bottles, even with large formats, awarded for 11.6 million dollars in Switzerland, by Baghera Wines, in recent days, not to mention that, on the Liv-Ex, last October, the “exposure” on the great investment wines, (the total value of the requests and offers), exceeded the record of 50 million pounds, well 6 million pounds more than the same month of 2017, and with a value that has doubled in 3 years.

Copyright © 2000/2026

Contatti: info@winenews.it

Seguici anche su Twitter: @WineNewsIt

Seguici anche su Facebook: @winenewsit

Questo articolo è tratto dall'archivio di WineNews - Tutti i diritti riservati - Copyright © 2000/2026