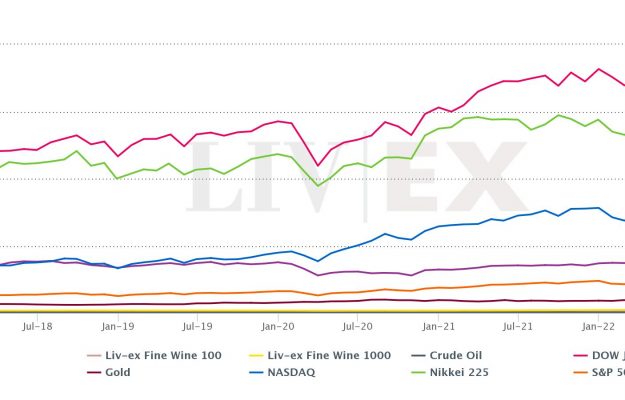

December was not a fantastic month for the stock markets, which closed 2022 exactly as expected: at a loss. The crisis of financial investments, which actually goes far beyond the stock exchanges, ended up involving many other categories, from oil to fine wines, saving only gold. As a matter of fact, the last month of the year registered 0.2% drop in the Liv-ex 100. It was the third consecutive negative month for the index that analyzes price trends of the 100 most sought-after wines on the secondary market (these wines include Barolo 2016 by Bartolo Mascarello, Barolo Monvigliero 2016 Comm. G.B. Burlotto, Barbaresco 2018 by Gaja, Barolo Monfortino Riserva 2013 and 2014 by Giacomo Conterno, Masseto 2016 and 2017 and Ornellaia 2018 by Frescobaldi, Brunello di Montalcino 2016 from Poggio di Sotto, Sassicaia 2016, 2017 and 2018 from Tenuta San Guido, Solaia 2018 and Tignanello 2016 and 2018 from Antinori and Soldera Case Basse 2016).

Further, the Liv-ex 1000, which is the index that includes the seven regional indices of the Liv-ex (Bordeaux 500, Bordeaux Legends 40, Burgundy 150, Champagne 50, Rhone 100, Italy 100 and Rest of the World 60), and analyzes the trading activity of 600 wine merchants, closed the year in negative territory, that is, -0.4%, while Italy 100 did even worse, and lost -0.6%.

The drop in fine wines, however, is definitely much lower than others, like for instance NASDAQ that registered 6.9% loss in December 2022. Continuing on Wall Street, Dow Jones did a little better, limiting losses to - 2%, while the most important United States stock index, Standard & Poor’s 500, closed at -3.6%. On the Tokyo Stock Exchange, Nikkei 225 closed at -7.6%, while the stock index of the 100 most capitalized companies listed on the London Stock Exchange, the FTSE 100, closed the year on a slightly positive note: +0.2%. In general, the best investment was in the ageless safe haven assets such as gold, which gained + 2.8% in December 2022, while oil registered the worst drop ever: - 11%.

The slowdown registered in the last quarter of the year, however, should not, though, give the wrong impression, since in 2022, focusing on fine wines proved to be a good investment in any case. The Liv-ex 100 gained 6.9%, the Liv-ex 1000 gained 13.1%, the Italy 100 gained 9.2%. None of the others has been able to do better, not even gold, which has been through a very challenging two-year period, and in fact last year gained just 0.5%. Only the FTSE 100 closed in positive territory (+0.9%), all the other stock indexes — as the historic drops of giants like Apple and Tesla have tangibly indicated — registered significant drops. Nasdaq lost 33.1%, Standard & Poor’s 500 lost 19.6%, Dow Jones lost 8.8% and Nikkei lost 9.4%. Oil instead did well and gained 6.2% in 2022, even though a drastic drop in prices is expected during 2023.

It should be emphasized, however, that a good investment should be measured not only in the short term, but also in the long term, and as a matter of fact, data relating to the last 5 years is clearly positive. The Liv-ex 100 gained 34.2%, Liv-ex 1000 gained 45.3%, Italy 100 a whopping 46.8%, proving to be the best investment of any of the others, except for Nasdaq , which registered + 51.6%. On the Stock Exchange, Nikkei 225 has grown + 14.6% over the last 5 years, Standard & Poor’s 500 has grown + 43.6% and the Dow Jones has grown + 34.1%, while the FTSE 100, which has had to pay for Great Britain’s choice to leave the European Union, lost 3.1% over the same period. Finally, gold gained + 40.1%, and the price of oil has grown + 33.2% over the last five years.

Copyright © 2000/2025

Contatti: info@winenews.it

Seguici anche su Twitter: @WineNewsIt

Seguici anche su Facebook: @winenewsit

Questo articolo è tratto dall'archivio di WineNews - Tutti i diritti riservati - Copyright © 2000/2025