One of the issues that is currently causing concern in the world of wine, and alcohol in general, is the decline in consumption and the shift towards other types of drinks, driven by the younger generations and increasingly oriented towards health trends. This is a well-known phenomenon, but one that should perhaps be considered alongside, at least in terms of importance, the decline in Italians’ purchasing power, given that it is not only alcohol consumption that is falling, but also consumption of non-alcoholic beverages, which, in 2024 and the first quarter of 2025, is down, as is food consumption. The “Away from Home” (AfH) market generated €101 billion in 2024, falling to €81 billion in the “AfH consumer tracking” perimeter, which excludes foreign tourists, minors under 18 and adults over 75, vending machines, and school/religious/military groups from the scope of analysis. And while 2024 saw a slowdown in visits (-1.6%) and a slight increase in value (+0.7%), in the first five months of 2025, the out-of-home consumption market started the year with the brakes on (-2% in visits) and a +1.5% increase in value, thanks mainly to a good performance (+7.4%) in April (characterized by the Easter period, ed.).

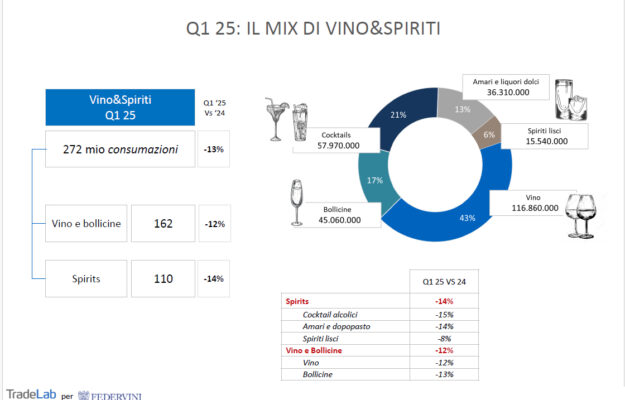

Here are the figures, taken from the report by Osservatorio TradeLab by Federvini, dedicated to out-of-home consumption, which also shows a sharp decline in alcoholic beverages in the first quarter of 2025 (-11.4% for 440 million consumptions compared to 496 in the first quarter of 2024), the macro-category that recorded the worst figure in terms of consumption, which, overall, recorded a -5.6% decline. In the first four months of 2025, the scenario was therefore not positive: wine & spirits reached 272 million consumptions (-13%) and all beverages recorded a negative trend. Wine, with 116.8 million consumptions, fell to -12% compared to the first quarter of 2024, sparkling wines to -13% (45 million consumptions). The spirits category is down 14%, again comparing the first four months of 2025 with those of 2024, a figure derived from alcoholic cocktails (-15%, 57.9 million servings), bitters and after-dinner drinks (-14%, 36.3 million servings), and straight spirits (-8%, 15.5 million servings). Data for sweet foods (510 million, -5.2%) and savory foods (1.2 billion, -4%) are also down. And in 2024? The market value was €81.3 billion for out-of-home consumption, with an average receipt of €10.4 and 7.8 billion visits. Wine and spirits generated 1.45 billion drinks (-0.8% on 2023), of which 592.2 million were wine, 228.4 million sparkling wine, 367.9 million cocktails, 182.5 million bitters and sweet liqueurs, and 79.6 million spirits. Wine and sparkling wine grew by 0.1% (+1% for wine, -1.9% for sparkling wine) between 2023 and 2024, while spirits fell by 2%. White wine (49%) is consumed more than red wine (46%) and rosé (6%). Among sparkling wines, Prosecco dominates (81%), ahead of spumante (15%) and Champagne (4%). In the cocktail category, the most popular drink is spritz: Spritz Aperol (34%) is followed by Spritz Campari (14%), Gin and Tonic (8%), Americano (5%), and Negroni (4%). In 2024, there were 2.42 billion alcoholic beverage consumption (-1.3%) and 4.68 billion non-alcoholic beverage consumption (-0.6%). Breakfast is the only time of day linked to consumption opportunities that is growing (+0.7%). However, in terms of the various channels, bars lost 1.8% in 2023, restaurants remained stable, and food delivery saw a significant decline (-7.4%). Street vendors, kiosks, and street food are the best performers (+6.4%), ahead of restaurants and trattorias where you spend more than 35 euros (+6.2%), ice cream parlors (+3.5), fast food/self-service chains (+2%), and restaurants mainly serving pizza (+1.9%). Discos collapsed, coming in last with -9.7%. The age group that “visits” establishments the most is 45-54, while the group with the “heaviest bill” (€11.2) is 25-34. The target of the TradeLab by Federvini analysis is the Italian population aged 18 to 74, which is equal to 45 million individuals.

Copyright © 2000/2026

Contatti: info@winenews.it

Seguici anche su Twitter: @WineNewsIt

Seguici anche su Facebook: @winenewsit

Questo articolo è tratto dall'archivio di WineNews - Tutti i diritti riservati - Copyright © 2000/2026