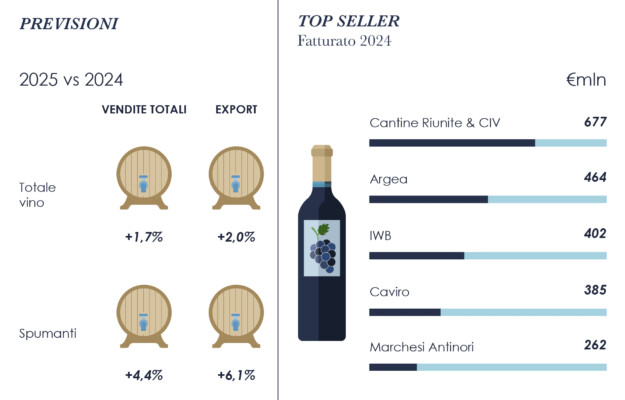

024 was a definitely challenging year in the wine world for many reasons, including the climate crisis, changes in consumption habits, international issues and economic difficulties. The wine world is expecting slight growth in 2025, in spite of the ongoing international situation, such as, but not only, the issue of US tariffs, which is holding the sector in a state of uncertainty. According to the Mediobanca Research Area survey on the wine sector in Italy, including 255 major Italian capital companies whose turnover in 2023 reached more than 20 million euros, and aggregate revenues 11.7 billion euros, equal to 94.9% of the National turnover in the sector, the major wine producers expect +1.7% sales growth in 2025, and exports to grow +2%. The optimism for bubbles has continued (estimated overall revenues up +4.4%), especially abroad (exports up +6.1%), while still wines are expected to grow +0.9% (exports up 1.2%).

The future, however, is still full of fear and worries. The survey revealed that lower incomes, the expected drop in wine consumption, and therefore making appropriate adjustments, prompted by generational change and the widespread increase in healthy models, worry 70% and 60% of companies, respectively.

There is widespread fear and worry about the uncertainty of the American administration’s decision to impose tariffs on wine imports. Fifty percent of companies consider the new Italian Highway Code a threat to the sector, while 30% are worried about the effects of climate change. More than three-quarters of Italian wine companies said that difficulties in dealing with demand can be overcome by opening up to new markets. As far as restructuring the offer, the priority for 50% of companies is developing the no/low alcohol categories. Regarding the future, investments in human capital are considered essential for 55% of professionals, more than technological investments, focused on artificial intelligence and automation, which is important for a third of the companies.

The survey revealed that the major Italian wine producers closed 2024 at no significant variation (+0.3% compared to 2023), and a greater increase on the foreign market (+0.7%). Sparkling wines’ excellent performances abroad stand out (+9.1%). The EBIT margin registered +0.5 percentage points increase compared to 2023, while the ratio between net profit and turnover was 0.2 points. In 2024, quantities sold on all channels decreased -2.5%, while sparkling wines were up +4.1%. On-premise sales instead lost shares, -4.9% compared to 2023. The value of the HoReCa (hotels restaurants catering) channel reached 17.6% of the market, but wine shops and wine bars (market share at 5.7%) registered -8.4% drop. Direct sales increased slightly (+1.3% compared to 2023), and were 8.2% of the market. Wine tourism did quite well. It grew in 2024, as revenues were up +9% compared to 2023, and three-quarters of the companies offered visits to their wineries. Organic wines have reached 5% of the market (-2.6% in sales), while “natural” wines grew (+4.2%, 1.9% market share) and vegan wines also performed well (+31.7%, market share 0.9%). Reports have indicated that 60% of companies are dedicated to sustainability, and in 16.7% of cases, have a manager exclusively for ESG (Environmental, Social, and Governance, ed.). Usually, however, this is handled by a manager who also has other corporate functions (38.2% of professionals) or directly by the president, CEO or General Manager (about 25% of companies).

Regarding the best-performing Italian wineries in sales in 2024, the Mediobanca Research Area survey on the wine sector in Italy reported that the number one position is still Cantine Riunite-GIV Group (Gruppo Italiano Vini), boasting 676.6 million euros in turnover (+0.6% compared to 2023). The Argea Wine Group is in second place (464.2 million euros, +3.3%), followed by Italian Wine Brands (WB) at 401.9 million euros (-6.3% compared to 2023). In 2024, the company with turnover above 300 million euros was the Romagna Cooperative Caviro (385.2 million euros), down -9% compared to 2023. Ten companies were in the revenue range between 200 and 300 million euros, including the Tuscan winery Antinori (2024 turnover equal to 261.6 million euros, up +7.4% compared to 2023), the Trento Cooperative Cavit (253.3 million euros, -5.2%), La Marca, specialized in producing sparkling wines, 251 million euros turnover in 2024 (+11%), the Venetian Herita Marzotto Wine Estates (248.2 million euros, -2.8%), Collis Group (219.3 million euros, +4.7%), the Trento Cooperative Mezzacorona (212.3 million euros, -2.5%), Terre Cevico Cooperative (211.3 million euros, +7.4%), Zonin 1821 (209.3 million euros, +7.8%), Mack & Schühle (205.6 million euros, +19.3%) and the Piedmont Fratelli Martini (200.1 million euros, -8.3%). As far as profitability (ratio between net profit and turnover), in 2024 the Venetian Herita Marzotto Wine Estates was number one (17.8%), followed by Antinori (12%) and Mionetto, which registered +9.2% profit on turnover. Some companies registered a very high export share, and in some cases almost total, which were Fantini Group at 96.1%, Ruffino 93.3%, Argea and Pasqua at more than 90%.

On the territorial level, the Mediobanca Research Area survey specified that Veneto has once again been confirmed the leading wine region in Italy, in which a quarter of the total quantities of Italian wine are produced. Veneto is also the leader in value, at more than 20% of the National total. The Puglia region follows (volume equal to 16.1% of the total, value 12.6%). In Piedmont and Tuscany the weight in volume is between 4 and 5% of the total, while value doubles (for both Regions, close to 10% of the Italian total). Sicily, instead, is the Region that has the greatest gap in quantity compared to value. Veneto also leads exports (more than 35% of Italian exports), doubling Piedmont and Tuscany, totaling 15% each. The top Regions as far as end of year statements were the following: Tuscany leads at the highest EBIT margin (16.4%). Abruzzo had the best ROI (7%), Piedmont in second place (6.4%). The top exporters were producers from Piedmont (63% turnover), Tuscany (59.5%) and Abruzzo (58.7%). Puglia and Lombardy had the best ROE (6.6% each);, while Lombardy excelled in EBIT margin (second place, at 10.9%), but only modest abroad (exports equal to 24.3%). In 2024, the Friuli companies grew the most (+8.2% overall sales, and +7.1% abroad). and Tuscany (+2.3%; +4.6%). The outlook for 2025 is optimistic for companies from Abruzzo (overall sales +7.5%).

In general, the internationalization of wine is growing. Now, nearly one bottle out of two is consumed in a Country outside of the production Country (ratio between exports and consumption grew from 27% in 2000 to 46.6% in 2024). In 2024, world wine production was estimated at 226 million hectoliters, down 4.8% compared to 2023, while consumption stands at 214 million hectoliters (-3.3%). Italy instead went against the trend. That is, +15.1% in production compared to 2023 (therefore, positioned at the top of the ranking), and +0.1% in consumption, at 37.8 liters per capita per year). The trade balance was also positive, since over a 20 year period it has grown at 5.5% average annual rate, increasing from 2.6 billion euros in 2004 to 7.5 billion euros in 2024. Furthermore, Italy was the leading wine exporter in quantity (21.7 million hectoliters in 2024) and second place in value (8.1 billion euros behind France's 11.7 billion).

Copyright © 2000/2026

Contatti: info@winenews.it

Seguici anche su Twitter: @WineNewsIt

Seguici anche su Facebook: @winenewsit

Questo articolo è tratto dall'archivio di WineNews - Tutti i diritti riservati - Copyright © 2000/2026