In Old Europe wine is generally not among the products targeted by the Ministry of Finance, so that, in most of the European Countries, there are no taxes on wine except VAT, which, however, is levied on any other product, in different measure from one place to another.

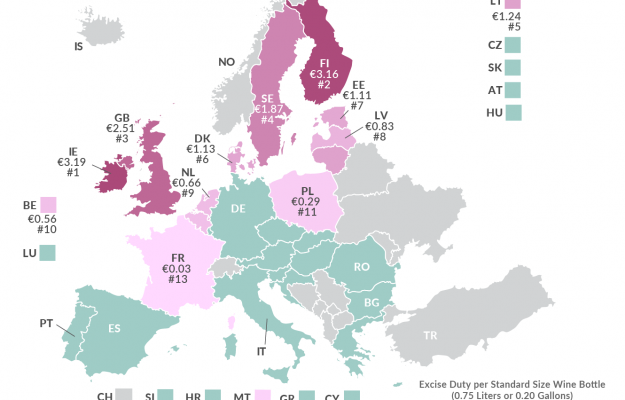

On a single bottle of wine, as revealed by the “Tax Foundation” portal, the highest level of excise duty is imposed by Dublin: in Ireland excise duty is 3.19 euros for a bottle of 0.75 liters. A little less in Finland, where excise duties on wine are 3.16 euros per bottle, whereas in Great Britain taxes on wine amount to 2.51 euros per bottle. The tax burden on wine is considerable also in Sweden (1.87 euros), Lithuania (1.24 euros), Denmark (1.13 euros), Estonia (1.11 euros), Latvia (0.83 euros), Holland (0.55 euros) and Belgium (0.56 euros).

Decidedly lower, instead, are the excise duties in Poland (0.29 euros) and in Malta (0.15 euros), whereas in France, the only producing country which taxes one of its symbolic products, the lowest excise duty of all Europe: 0.03 euros per bottle.

In all the other countries, from Italy to Spain, from Portugal to Germany, from Austria to Greece, there is not any type of additional tax on wine, almost universally recognized as a pillar of the gastronomic culture of the Mediterranean and, by extension, of Europe.

Copyright © 2000/2025

Contatti: info@winenews.it

Seguici anche su Twitter: @WineNewsIt

Seguici anche su Facebook: @winenewsit

Questo articolo è tratto dall'archivio di WineNews - Tutti i diritti riservati - Copyright © 2000/2025