For years, Hong Kong was called the great gateway to Asia for world wine, the showcase of the West to which China looked. But the political events of recent times, with an island increasingly under Chinese control and less and less independent and “free”, the pandemic, which in China is still being managed with the ineffective logic of “zero contagion”, and with the growth of so many small Asian markets around a giant that, to date, has never really taken off, at least for Italian wine-and that after making the fortunes of Australian wine has abruptly closed its doors to it-the picture has abruptly changed. And so, the French, who even in China are firmly the market leader for exported wine, have made a radical choice: Vinexpo Asia, which was supposed to be staged in Hong Kong in this 2022, but will not take place, from 2023 will move, structurally, to Singapore, one of the markets that has grown the most in recent times, in the iconic luxury hotel, Marina Bay Sands. This is reported by the French magazine “Vitisphere”.

“Today Singapore has become the platform for wines in Asia. Vinexpo Asia aims to serve the same number of companies and operators as ever, we are banking on Singapore to be big”, said Rodolphe Lameyse, general manager of Vinexposium, pointing out that the event will be annual, on an area of 8,000 square meters, capable of hosting between 1,300 and 1,400 exhibitors. This is not to say that China will be “neglected”, on the contrary: the return of Vinexpo to Shanghai will be possible in 2023, stressed Lameyse, for whom “the big challenge in 2023 is to confirm Wine Paris & Vinexpo Paris”, scheduled for February 13-15”.

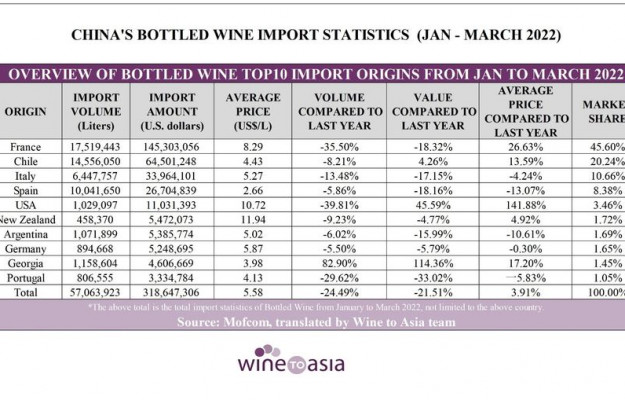

Meanwhile, as previously reported in recent days by WineNews, and as confirmed recently by data from the Chinese Ministry of Commerce analyzed by Wine2Asia, the China operations arm of Veronafiere and Vinitaly, in the first 3 months of 2022, wine imports into the Dragon country recorded another major decline, by -21.5% in value (to $318 million) by -24.5 in volume for still wines (to 57 million liters), and by -14.1% in value (to $22.4 million) and -39.1% in volume (to 1.8 million liters) for sparkling wines. France, on still wines, lose -18.3% in value, but remains widely the leader with $145 million, and -35% in volume, at 17.5 million liters. Italy, on the other hand, clocks in at $33.9 million (-17.15%)-and is now third, behind the transalpines and Chile, at $64.5 million, up +4.2%-at 6.4 million liters (-13.4%). In sparkling wines, France still No. 1 in value with $16 million (-11.5%) with just 338.960 liters (-51.6%), while Italy, first in volume, with 1.1 million liters (-27.4%), and second, at a great distance, in value, at $4.4 million (-11.5%).

Copyright © 2000/2026

Contatti: info@winenews.it

Seguici anche su Twitter: @WineNewsIt

Seguici anche su Facebook: @winenewsit

Questo articolo è tratto dall'archivio di WineNews - Tutti i diritti riservati - Copyright © 2000/2026