Italian wine exports will continue to grow in the US and Canada in the next few years, while regarding emerging markets, China should show a positive and substantial turnaround, as should Russia, excepting any “unpredictable geopolitical events”. And, many opportunities will come from Japan when it enters the free trade agreement with the EU starting in 2019. In the meantime, it is likely that our wine shipments will just mark time in Germany, where overall consumption is not increasing, and they are moving more and more towards local productions, as well as in the UK, where the effects of Brexit and the devaluation of the pound will be heavily felt. The sparkling trend will continue even on emerging markets (Eastern Europe and Asia), which are still only marginally involved in this boom. These are some of the prospects Nomisma-Wine Monitor outlined at the Federvini assembly in Rome.

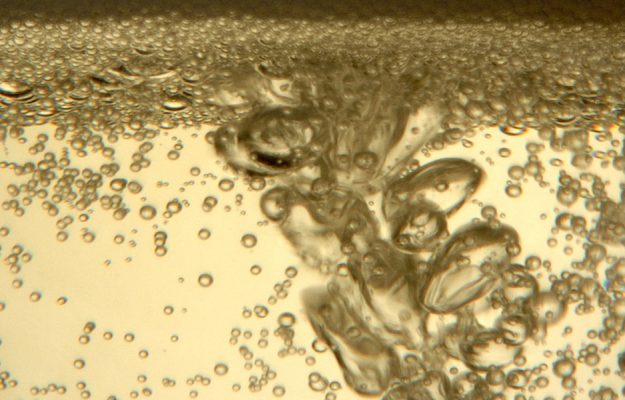

In the first part of 2018, signals of greater vitality have arrived from bubbles. In the first three months of the year, Italian sparkling exports have registered +11% in the US, +14% in UK, +44.8% in China, +25.3% in Japan, +10.6% in Switzerland, +28.1% in Russia and +1.7% in Germany. The only country out of trend, for Italian sparkling wines, was Canada, at minus 6.7%.

Bottled still wines, instead, are continuing a downslide just about everywhere: 2.3% less in the US, 13.1% less in the United Kingdom, 2% less in Germany, 4.4% less in Switzerland, 13.1% less in Russia. In Canada there is a slight growth (+1.9%), but the most positive news comes from Asia, +41% in China and +13.6% in Japan.

The picture is good and bad, therefore, and describes the complexity of growing in world markets, where now Italian producers will have to deal with more and more consolidated trends. On the one hand, the growing demand for organic and “sustainable” wines , which in Italy are still a niche (less than 1% of total sales, emphasized Nomisma), but 25% of consumers know and purchase them. On the other, there is an increasingly clear push towards premiumization of wine consumption, especially in North America and Europe.

“At the beginning of 2018, Prosecco was still the leader of export growth” Denis Pantini of Nomisma-Wine Monitor explained to WineNews, “while the United Kingdom and the United States are slowing down somewhat on still wines, unlike China, where growth was over 40% in the first quarter, although, it must be said, they started from lower numbers. Even in Italy. The biggest growth is the sparkling segment, both in mass retail and the food service industry, Horeca, thanks above all to the millennials who appreciate this typology very much, and which is the only real growth trend in Italy”.

In conclusion, Italian wine is growing overall, even though it is evident growth is slower than in the past. “And, at this rate, the goals of 50 billion euros in agro-food and 7.5 billion euros in wine exports will not be for 2020, as we had set for ourselves, but delayed one or two years”.

Copyright © 2000/2025

Contatti: info@winenews.it

Seguici anche su Twitter: @WineNewsIt

Seguici anche su Facebook: @winenewsit

Questo articolo è tratto dall'archivio di WineNews - Tutti i diritti riservati - Copyright © 2000/2025