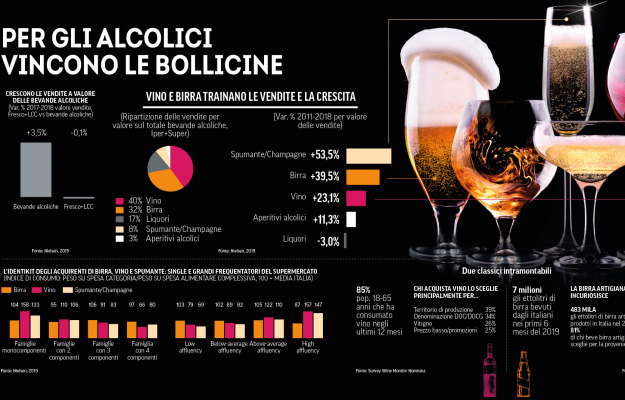

In a context that is at least worrying, if not discouraging, such as that outlined in the “Coop 2019 Report - Consumption and lifestyles of Italians today”, from which emerges a stagnation in consumption due to an increasingly evident slowdown in the economy of Italy, combined with a certain distrust for the future, the sales of alcoholic beverages, which show a comforting +3.5%, go into sharp contrast. A “cake” in which the weight of wine is 40%, that of beer 32%, that of liqueurs 17%, that of sparkling wine and champagne 8% and that of aperitifs 3%. Sparkling wines, in a long-term dynamic (2011-2018), show the greatest evolution: +53.5% of purchases in large-scale distribution, followed by beer (+39.5%), still wines (+23.1%) and alcoholic aperitifs (+11.3%), while liqueurs lose -3%.

In the last 12 months, 85% of consumers between 18 and 65 years of age have drunk wine, choosing it on the shelf, essentially on the basis of four assumptions: territory of production (39%), DOC or DOCG (34%), grape variety (26%) and low price or promotions (25%). Seven million hectolitres of beer were drunk by Italians in the first six months of 2019, with craft beer reaching 483,000 hectolitres in 2018, with 81% of those who drink it choosing it for its local origin. The main buyers are singles and those who go to the supermarket more often (the so-called “high affluency”), especially when it comes to wine, while families and those who go shopping less frequently (the “low affluency”), prefer beer.

Finally, a look at the soft drinks that, as the Report reveals, “lose gas” in every sense: expenditure for the category falls (-0.9%), with water (45% of sales in the category) at the top, followed by carbonated drinks (25%), juices and juices (16%), flat drinks (10%), preparations (2%) and soft drinks (2%). For the period 2011-2018, carbonated drinks in particular show the worst figure: -7.8% of sales, against a growth of +23.5% in water, +18.8% in flat drinks and +4.4% in soft drinks. The industry is also adapting to the needs of the market, and among the most performing categories stand out the low-calorie drinks (+42% growth between 2008 and 2016), while in the first months of 2019 there is a boom in sales of flavored waters (+164.7%). Italians, therefore, are penultimate in Europe for soft drink consumption, with 51.2 liters per capita: Germany is first at 139.6 liters per capita, followed by Denmark (124.7 liters) and Belgium (122 liters).

Copyright © 2000/2026

Contatti: info@winenews.it

Seguici anche su Twitter: @WineNewsIt

Seguici anche su Facebook: @winenewsit

Questo articolo è tratto dall'archivio di WineNews - Tutti i diritti riservati - Copyright © 2000/2026